Mon, Jan 17, 2022

Cards test 2021 European Goodwill Impairment Study: An Overview

We recently published the 2021 European Goodwill Impairment Study, which explores goodwill impairment trends by companies in the STOXX® Europe 600 Index, focusing on 2016-2020 calendar years.1

Our inaugural study was launched in 2013 and focused on the 2010-2012 calendar years, which enabled us to capture goodwill impairments recorded across countries and industries at the height of the Euro sovereign debt crisis. We find ourselves again in a period of significant upheaval, with companies forced to navigate the global economic crisis created by the outbreak of COVID-19.

The most recent five-year period was characterised by economic uncertainty within Europe. Economic slowdown in 2019 had already clouded the outlook for many companies, leading to an increase in goodwill impairments. The outbreak of COVID-19 led to the worst global economic recession since World War II. Most major economies saw sizable contractions in 2020, with real GDP declining by 6.3% in the Eurozone, eclipsing the decline observed in 2009.2

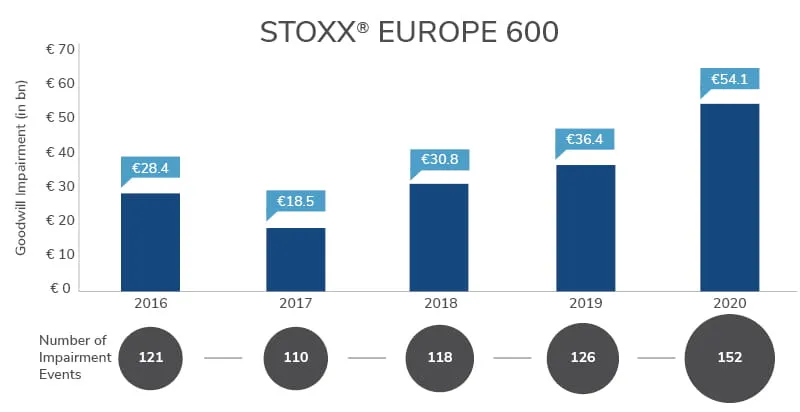

Total goodwill impairment recorded by European listed companies in the STOXX® Europe 600 increased for a third consecutive year. Goodwill impairment rose 49% to €54.1 billion (bn) in 2020. This was the highest level in aggregate goodwill impairment for the STOXX® Europe 600 since 2012 (at €66.4 bn), but not as severe as it could have been. The swift actions by governments and central banks, with unprecedent levels of fiscal and monetary support, enabled many businesses to bounce back from the plunge in economic activity related to lockdowns.

The number of goodwill impairment events increased for a third consecutive year, rising from 126 in 2019 to 152 in 2020, or 21%. At the same time, the average impairment amount per event also increased by 23%, from €289 million (mn) to €356 mn over the same period.

With this environment as the backdrop, European M&A activity was mixed in 2020, with larger deals skewed towards the start of the year.3 The number of closed M&A transactions in the Eurozone decreased by 8% in 2020, but deal value more than doubled (up 118%). However, almost 80% of the deal value was linked to transactions announced before March 2020, prior to COVID-19 being declared a pandemic. The UK had a similar story with an overall decline in deal volume for the year (down 15%) and an increase in deal value (up 34% in € terms). Yet, two-thirds of the deal value related to transactions announced prior to March 2020.

Industry Highlights

- The top three industries with the most significant increase in goodwill impairment amounts in 2020 are as follows, in order of magnitude (€ bn):

- Financials & Real Estate (€17.2 to €22.6)

- Materials (€1.1 to €5.7)

- Communication Services (€0.6 to €3.9)

- Financials & Real Estate topped the list for the third consecutive year, registering its highest goodwill impairment level since 2011.

- Materials registered its highest goodwill impairment level since 2013, as the pandemic lockdowns delayed construction projects and disrupted global supply chains.

- Consumer Staples was the only industry seeing a decline in 2019, as demand for necessities helped offset some of the adverse effects of the pandemic. However, the aggregate goodwill impairment in 2020 was still the second highest level registered by this industry, following the record-high reached in 2019.

Geographic Highlights

- At €13.4 bn, Spain was the country within the STOXX® Europe 600 with the highest aggregate amount of goodwill impairment in 2020. This represented more than a threefold increase from the 2019 level (of €4.0 bn), but it was disproportionately driven by a single event.

- At €11.8 bn, the UK saw the second highest goodwill impairment amount, dropping from first place in 2019.

- Germany took the third spot, with aggregate impairment climbing to €9.7 bn, which was accompanied by a record-high number of impairment events for the country.

Additional Insights

Of the countries studied, the UK was the only country seeing a decline in aggregate goodwill impairment from 2019 to 2020. However, UK companies in the STOXX Europe 600 have impaired a significant amount of goodwill since the Brexit vote in 2016, due to the uncertainty created to businesses from exiting the European Union. In 2019, the UK reached its second highest goodwill impairment on record (since we began capturing data in 2010) at €19.3 bn, as Brexit uncertainty hit the outlook for UK companies severely. In the 2016-2019 period—prior to the outbreak of COVID-19—UK companies had impaired a cumulative amount of €43 bn, far outpacing any other European country.

Because in 2019 many UK companies had already revised projections downwards (or adjusted discount rates upwards for incremental risk) to reflect the protracted impact of Brexit, when COVID-19 hit in 2020, the incremental uncertainty to the UK business outlook was not as high on a relative basis, when compared to that in other European countries.

The pace at which UK companies have been impairing goodwill in the aftermath of the 2016 Brexit vote demonstrates that the goodwill impairment model is being applied on a timely basis to reflect the prevailing economic and business conditions. More generally, the impairment levels recorded recently in Europe demonstrate that the changes in the outlook for many companies that carry goodwill—precipitated by changes in the magnitude and timing of expected cash flows and associated risk—often lead to goodwill impairment, as intended by the current goodwill impairment-only model.

Goodwill and impairment continue to be topics of interest to standard setters and stakeholders. The International Accounting Standards Board (IASB) is currently considering introducing more useful disclosures about acquisitions that companies make and simplifying certain aspects of the current impairment-only model for goodwill. The IASB’s focus emphasises the need to provide information about management’s stewardship of a company as a key objective of financial reporting.

Robust and timely information provided to investors is a critical foundation of their decisions, which also benefits the smooth functioning of global capital markets and effective market oversight. Once again, this basic principle and the need for transparency is pushed to the forefront in a time of disruption.

Outside the global financial crisis of 2008-2009 and the ensuing Euro sovereign debt crisis, there has not been a time where information about goodwill impairment has been more important as in the current environment.

Download the full 2021 European Goodwill Impairment Study.

Sources:

1The STOXX® Europe 600 Index is derived from the STOXX® Europe Total Market Index and is a subset of the STOXX® Global 1800 Index. The index is weighted according to free-float market capitalisation.

2Growth in real gross domestic product (GDP) based on latest estimates at the time of writing. Source data retrieved on 9 September 2021 from https://ec.europa.eu/eurostat/data/database and https://www.ons.gov.uk/economy/grossdomesticproductgdp

3Source: S&P Capital IQ platform. M&A activity based on transactions closed in each year, where European listed companies acquired a 50% or greater interest.