Tue, May 28, 2019

The Six Hats of the AML Officer

The increasing complexity and regulatory scrutiny of combating money laundering has put the spotlight not only on a financial institution’s AML program, but also on the person chosen to run it. Financial institution boards, CEOs, and AML officers thus need to ensure that the role’s job description is aligned with reality. While the core responsibility of the AML officer is to design, implement, and manage an effective AML program, that is only the beginning of his or her responsibilities in the current environment. At most institutions today, the ideal AML officer must be able to fulfill six distinct roles:

- Risk Manager

While financial institutions are expected to have effective AML programs, what constitutes “effectiveness” is often left undefined. The onus is therefore on the institution to determine its enterprise AML risk and its risk appetite, and then to respond accordingly. The AML officer must be able to lead this effort across multiple lines of business, geographies, and customer bases, balancing the need to impose order on the risk assessment and management process with the recognition of the different ways that risk presents itself in various contexts. - Business Strategist

The repercussions of an incident make money laundering not just a compliance risk but a business risk. Giving the AML officer a seat at the table for business strategy discussions allows factors that contribute to that risk to be examined from the start rather than addressed after decisions have already been made. Being part of those conversations requires the AML officer to be a strategic and business partner with the board, the CEO, and business unit heads. In today’s highly dynamic environment, meeting with the board once a quarter is no longer sufficient. - Functional Advocate

AML is on every decision maker’s agenda–but so are digital transformation, globalization, disintermediation, and a host of other forces. The AML officer must be able to effectively lobby against similarly compelling initiatives for the fiscal, technological, and human resources to fulfill the function’s requirements. Scrupulously submitted suspicious activity reports do little to mitigate risk without the resources to follow them up.

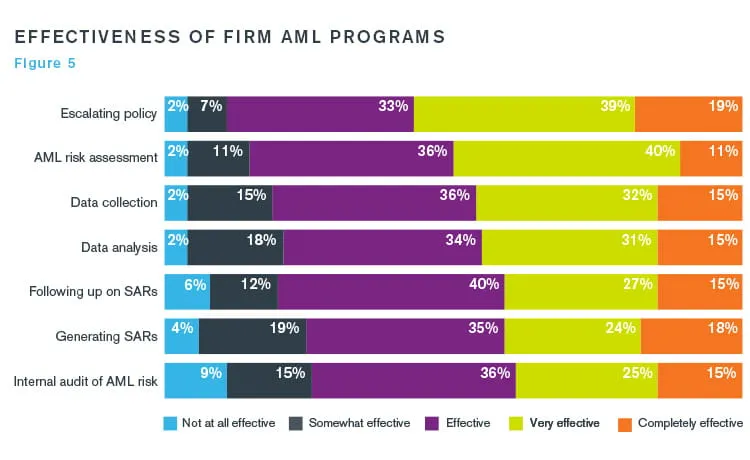

Figure 5: Our survey showed that while most firms are satisfied with the effectiveness of their AML programs, there is room for improvement, both among those who rate the components of their programs as less than effective and among those with effective programs who wish to evolve further. In addition, 30 percent of respondents rated at least one of their AML program components as less than effective.

- Global Thinker

AML efforts have always been multi-jurisdictional by definition. Today, however, financial networks are truly global and enforcement is becoming more so. The AML officer must have a thorough grasp of the changing positions of the players in this network–his or her institution, its clients or investors, and regulators and enforcement agencies at home and abroad. - Cultural Standard-setter

When an AML breach occurs, it is usually because commitment has flagged somewhere in the organization. Indeed, that commitment cannot be assumed and can easily wane over time, particularly since AML efforts, like all security measures, act as speed bumps in the continuing drive for business to grow and increase in speed and efficiency. The AML officer needs to be able to ensure that the appropriate institutional culture is reinforced in the messaging and actions of firm leadership and in the incentives of employees and management. - Innovator

The challenge of the AML officer is to prevail in an asymmetrical fight against people who don’t play by the rules. Doing so requires constantly expanding the toolkit: striving for continuous improvement; investigating new ways of using technology and data; and staying abreast of the insights of regulators, law enforcement, and peers at other institutions. The AML leader must then develop ways of integrating innovation into the AML program without disrupting its day-to-day operations.

Observers of business trends will recognize that the expanding requirements of the AML role follow a well-established pattern. Over the last two decades, functional leadership has been redefined, not just in financial services but also across industries. The chief financial officer, the chief information officer, the chief human resources officer and others have seen their responsibilities grow with the increased complexity of their functions and, a greater awareness of their functions’ contribution to the success of the enterprise. The AML officer’s role must now undergo a similar evolution, with the support of the firm’s leadership and introspection among those who hold the position.

Financial Services Compliance and Regulation

End-to-end governance, advisory and monitorship solutions to detect, mitigate, drive efficiencies and remediate operational, legal, compliance and regulatory risk.

Financial Crime Prevention

Financial crime risk has again risen to the top of the regulatory agenda, and remains one of the most immediate risks for many firms, with criminals constantly seeking new ways to circumvent protective controls.

Compliance Risk and Diligence

Complying with anti-money laundering and anti-bribery and corruption regulations.

Regulatory Advice and Consulting Services

Assistance to develop, implement, and manage global compliance and regulatory consulting programs.