Investment Firm Prudential Regime Support

Financial Services Compliance and Regulation

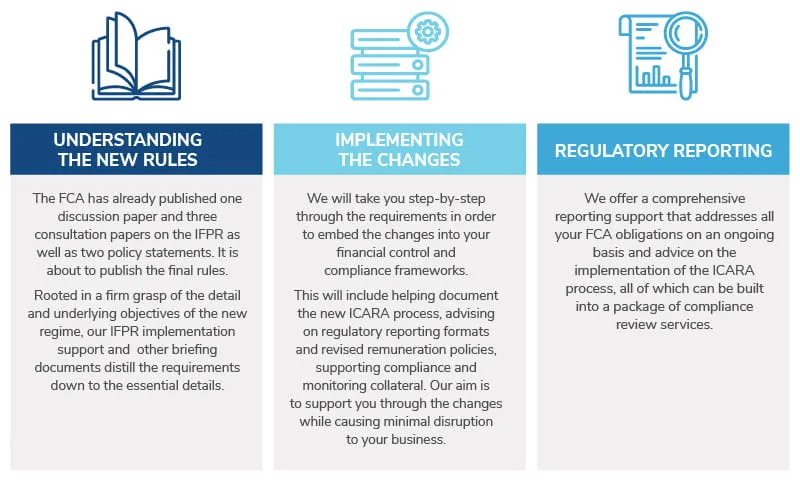

Kroll has a wide range of solutions designed to help UK firms with their Investment Firm Prudential Regime (IFPR) obligations. Our consultants can assist with navigating and understanding the new rules and provide guidance on the requirements contained within the European Directives and Regulations, FCA Handbooks and regulatory technical standards from European authorities.

What is IFPR?

The FCA’s domestic implementation of the Investment Firm Prudential Regime (IFPR) is coming into force from 1 January 2022. This Regime directly impacts UK firms authorised under UK MiFID and groups that they are involved with. Collective portfolio management investment (CPMI) firms when undertaking MiFID business are similarly affected.

The existing financial rules for investment firms were originally implemented in 1993 and are being substantially revised to move away from a banking approach to better align capital requirements to the risks that investment firms face.

The FCA is implementing the European IFPR through a new sourcebook, MIFIDPRU. The proposed new financial rules to be set out in the MIFIDPRU sourcebook will require MiFID investment firms and CPMIs operating in the UK to overhaul the way they measure and report their Own Funds Requirement and Liquid Asset Requirement.

MIFIDPRU represents a major change for investment firms; it is critical that firms act now to adequately prepare for the new regime.

What are the key changes that will impact firms?

- Changes to the level of initial capital to be held. Initial capital will become the Permanent Minimum Requirement and will increase for most firms

- Enabling the firms to understand its classification as an SNI or non-SNI and the associated capital requirements

- A new process called the Internal Capital and Risk Assessment (ICARA) process replacing the Internal Capital Adequacy Assessment Process (ICAAP)

- New rules on remuneration and disclosure that allow less scope for firms to determine their approach based upon proportionality principles

How we can help

Our team of Prudential experts can assist firms at all stages of their IFPR implementation and ongoing reporting and regulatory compliance.

Specific examples of where our team can advise on include:

- Enabling firms to understand its classification as an SNI or non-SNI and the associated capital requirements

- Assist in the analysis of any possible consolidation requirements

- Provide guidance on the K-factors if applicable

- Review the effects of the new requirements on your capital position with and without the use of transitional provisions

- Analyze the effects of the liquid asset requirement

- Advice to ensure key components of the ICARA process are in place

- Stress tests on capital and requirements

- Implement wind-down plan in line with FCA guidance

- Draft and update policies so they are fit for purpose and in line with the new requirements including remuneration, liquidity and other general policies and procedures

- Ensure processes are in place concerning disclosures

UK Compliance Services

Comprehensive compliance and regulatory support for FCA authorized firms.

Financial Services Compliance and Regulation

End-to-end governance, advisory and monitorship solutions to detect, mitigate, drive efficiencies and remediate operational, legal, compliance and regulatory risk.

U.S. Compliance Services

Comprehensive support for asset managers registering in the U.S.

Risk Alert : The SEC Re-confirms Its Framework For CCO Liability

by Ken C. Joseph, Esq., Anna Povinelli

10 Trends to Watch Heading Into 2023

SEC Division of Examinations Announces 2024 Priorities

by Ken C. Joseph, Esq., David Larsen, Alyssa Heim, Anna Povinelli

10 of the Biggest Geopolitical Risks by Likelihood and Impact

by Aaron Bradley, Emanuel Batista, Megan Greene