Mon, Jul 31, 2023

China Transactions Insights - Summer 2023

Following the lifting of domestic COVID-19 restrictions and boosted by a recovery in retail consumption, China’s economic growth rebounded to 4.5% for the first quarter of 2023, an uptick from the 2.9% GDP growth registered in the fourth quarter of 2022. The economy also recorded increases in fixed asset investment (4.0%), value-added industrial output (3.6%) and foreign trade (4.7%) for the first five months of 2023.1

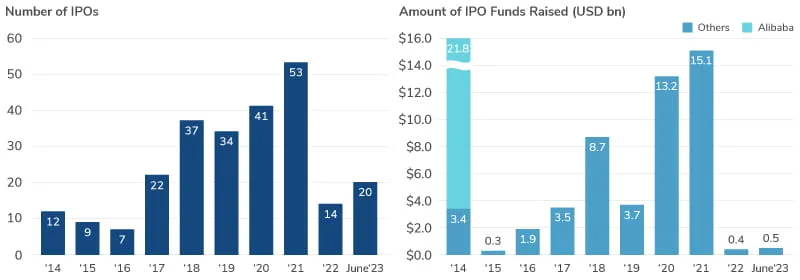

The first half of 2023 saw a modest recovery in the pace of U.S. IPO activity for Chinese companies after the significant drop-off in listings in 2022.2 However, activity remains well below the levels seen in 2020 and 2021, as market conditions and continued regulatory concerns have created a challenging environment for offshore listings of Chinese companies in the U.S.

Going-private transaction activity for U.S.-listed companies based in China slowed in 2023, with only one privatization completed during the year through June and two potential transactions announced that have yet to close. U.S.-listed Chinese companies with pending going-private proposals represented about USD 4.5 billion in total market capitalization as of June 30, 2023

China Transactions Insights Valuation Data

China Transactions Insights Valuation Data

The first half of 2023 saw a modest recovery in the pace of U.S. IPO activity for Chinese companies after the significant drop-off in listings in 2022. However, activity remains well below the levels seen in 2020 and 2021. Download our China Transactions Market and Transaction Data for more insights across IPO’s, Going Private Transactions and more.

Corporate Finance and Restructuring

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Mergers and Acquisitions (M&A) Advisory

Kroll’s investment banking practice has extensive experience in M&A deal strategy and structuring, capital raising, transaction advisory services and financial sponsor coverage.

Transaction Advisory Services

Kroll’s Transaction Advisory Services platform offers corporate and financial investors with deep accounting and technical expertise, commercial knowledge, industry insight and seamless analytical services throughout the deal continuum.

Fairness and Solvency Opinions

Duff & Phelps Opinions is a global leader in Fairness Opinions and Special Committee Advisory, ranking #1 for total number of fairness opinions in the U.S., EMEA (Europe, the Middle East and Africa), Australia and Globally in 2023 according to LSEG (FKA Refinitiv).